When the price moves above a resistance level or moves below a support level, it is called breakout.

Breakout price movement can be described as sudden, directional movement in the price followed by increasing volatility and heavy volume.

The traders who trade with breakout have motto, “No price is too high to buy and no price is too low to sell.

All traders are not able to understand the same support and resistance level, that’s why, the breakouts can be subjects

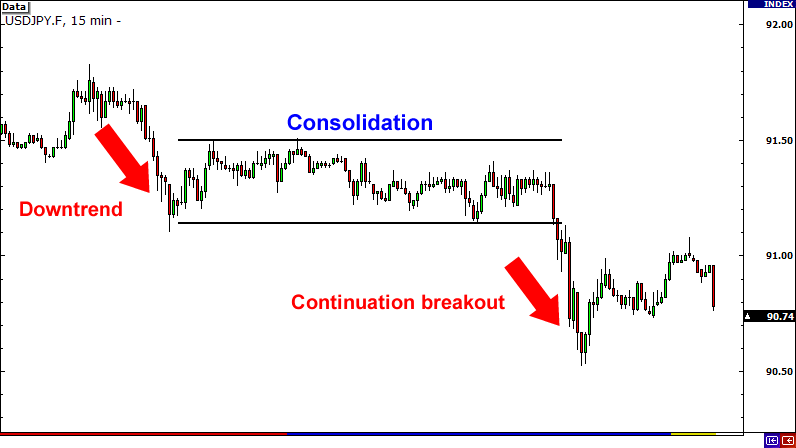

The breakouts show that the Increasing price will start trending in the direction of the breakout.

A breakout to the upside indicates that the price will start trending higher. This signals traders to possibly go long or exit short positions.

The resistance level acts as reversible and changes to a support level if price goes with a correction or pull back, once the resistance level is broken.

As defined, the downside breakout is called a breakdown. The price will trend lower that shows the trader may get short, exit or long positions.

The high volume occurring breakouts (relatively normal volume) hint the greater conviction, in which it is expected that price will trend in that direction.

On the other hand, the low volume breakouts (relatively normal volume) indicate that the conviction is weak and has more chances of failure. The price is less expected to trend in the direction of breakdown.

How to Trade Breakouts

When the price for some time remains below a resistance level or above a support level then the break out occurs.

The resistance or support level becomes a line in the sand that many traders use to set entry points or place their stop losses.

Usually two things occur when the price breaks through the support or resistance level:

Traders waiting for the breakout jump in.

Traders who had placed their stop losses in this area get stopped out.

This increase in buying and selling will often lead to an increase in volume, indicating that many traders were interested in the breakout level.

Breakouts are commonly associated with chart patterns, including rectangles, triangles, wedges, and pennants.

These patterns are formed when the price moves in a particular way in which support and / or resistance levels are formed.

These levels are monitored heavily by traders.

Traders will stay for a long time if price breaks above the resistance, whereas, the traders will stay for a while if price breaks below support.

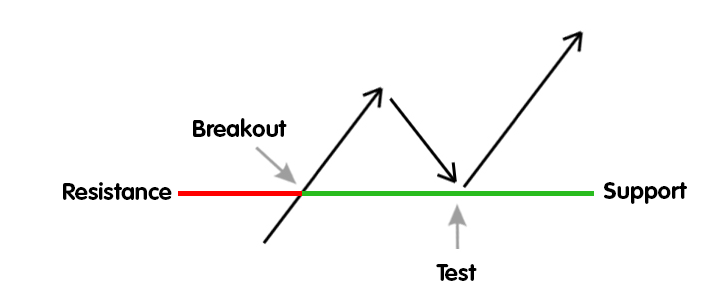

After a breakout, the price may return to the breakout point before moving back into the breakout direction, but not always.

After an upside breakout, the price may re-examine its previous resistance level, which has now changed to the support level.

After a breakdown (downside breakout), the price may retest its previous support level, which has now turned into a resistance level.

It occurs because some shorter-term traders will often buy the initial breakout, and then quickly take profit.

In order to exit their long position, they must sell. This selling temporarily drives the price back to the breakout point.

the price should move back in the breakout’s direction if there is an original breakout. If it doesn’t, it’s a “fakeout” or “failed breakout“.

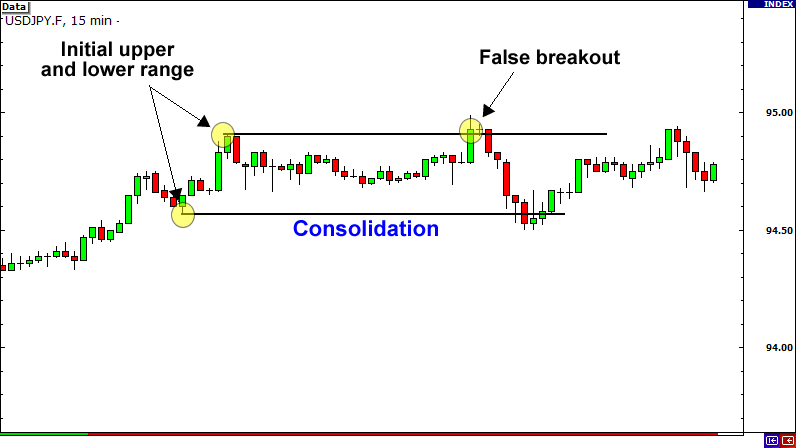

Fakeouts do occur regularly.

Price often exceeds resistance or support. This incorrect breakout forces traders to enter.

The price then reverses and fails to move towards a breakout.

This can happen several times before a real breakout.

Trading breakouts is not easy.

Trading chart patterns like triangles, flags, and pennants provide higher-probability breakouts than ranges (or rectangles).

Ranges attract traders who have opposite approaches because ranges are easier to identify:

Breakout traders

Range traders

The attraction does not occurs in the opposites. They create fakeouts in this situation.

A

Abandoned Baby | Account Statement Report | Account Value | Accumulation Area | Accumulative Swing Index ASI | Address | ADDY | ADP National Employment Report | Advance Or Decline Index | Afghanistan Afghanis | Agency Model | Aggressor | Alan Bollard | Alan Greenspan | Albania Leke | Algerian Algeria Dinars | Alligator | Altcoin | Analysts | Andrews Pitchfork | Angela Merkel | Angola Kwanza | Anti Money Laundering AML | ANZ Commodity Price Index | Application Programming Interface API | Appreciation | Arbitrage | Argentina Pesos | Armenian Drams | Aroon Oscillator | Aroon Up And Down | Aruban Guilder | Ascending Channel | Ascending Trend Line | Ascending Triangle | ASIC Mining | Asset | Asset Purchase Programme APP | Asset Purchases | Asymmetric Encryption | Asymmetric Slippage

B

Bag | Bag Holder | Bahmas Dollars | Bahrain Dinars | Bail In | Bail Out | Balance Of Trade | Baltic Dry Index | Bangladesh Taka | Bank Levy | Bank Of Canada BOC | Bank Of England BOE | Bank Of International Settlement BIS | Bank Of Japan BoJ | Bank Run | Bank Run | Banking Institutions | Bar Chart | Barbados Dollars | Base Currency | Base Rate | Basing | Basing Point | Bear | Bear Flag | Bear Market | Bear Trap | Bearish | Binary Options | Bitcoin Cash | Bitcoin Maximalist | Bitcoin Or BTC | Block | Block Explorer | Block Header | Block Height | Block Reward | Blockchain | Blue Chip | Bolivia Bolivianos | Bollinger Bands | Bond | Bond Auction | Bond Yeild | Book | Boris Schlossberg | Botswana Pulas | Brazilian Brazil Real | Breakdown | Breakeven | Breakout | Brent Crude | Bretton Woods Agreement Of 1944 | BRIC | Broadening Formation | Broker | BTD | BTFD | Bucket Shop | Bulgarian Leva | Bull | Bull Flag | Bull Market | Bull Trap | Bullish | Bullish Engulfing Pattern | Bundesbank | Burundi Francs | Business Inventories | Buy Side | Buying Pressure

C

Cable | Camarilla Pivot Points | Cambist | Cambodian Riels | Canadian Dollar | Cape Verde Escudos | Carbon Credits | Cardano ADA | Carry Trade | Cash Market | Catalyst | Cayman Islands Dollars | Cboe Eurocurrency Volatility Index | Central Bank | Central Bank Digital Currency | Central Bank Intervention | Central Counterparty Clearing Houses CCPs | Central Limit Order Book Or CLOB | Chaikin Oscillator | Chart Pattern | Chartist | Chicago PMI | Chilean Peso | Chinese Renminbi | Chinese Yuan | Christine Lagarde | Circulating Supply | Cleared Funds | Clearing | Clearing Price | Client | Closed Position | Cloud Mining | Coin Age | Cold Storage | Collateral | Colombian Pesos | Comdoll | Commercial Corporations | Commission | Commitments Of Traders Report Or COT | Commodity | Commodity Channel Index Or CCI | Commodity Futures Trading Commission CFTC | Commodity Research Bureau Index | Commodity Trading Advisor CTA | Communaute Financiere Africaine Francs | Comoros Francs | Completeness | Compound COPM | Comptoirs Francais Du Pacifique Francs | Conference Board Consumer Confidence Index CCI | Confirmation | Confluence | Congo Congolese Francs | Consensus Algorithm | Consolidation | Consumer Price Index CPI

ForexTrading.pk