An optional contract having payout completely depending upon the yes or no output or true or false statement is called a Binary Option.

Here no need to worry about the complication of name because binary options are a simple method for trading as compared to currencies or commonly used trading options.

Binary Options can also be expired, have a strike price and premium same of traditional options.

The key difference is here is that a trader selects a premium amount for the option and its expiry tenure is shorter than traditional options.

The expiry tenure for the traditional options May be a week or a couple of years whereas, the binary options may be expired even less than a Minute to a few day.

These factors make the larger difference in the way to calculate the profitable trade.

Now we are going to know the functionality of binary option trades.

In the binary option trade, the broker will see and check the conditions (e.g., the market price is at or beyond your target strike at expiration with a call option) to pay out a percentage of premium at risk.

Actually, you get a fixed profit which is usually predefined rather than the conditions of the contract are met of market moves beyond the strike price.

Binary options are also known as “all-or-nothing” options because it’s by 1 pip or 1,000 pips, it’s the same profit payout at contract expiration; there is no middle ground.

How To Make Money Trading Binary Options

Now we will discuss the way to make money using binary options and will know how the binary option trade works. Let’s see the following example

If you are going to trade EUR/USD while assuming that the price will increase.

If the current price of the pair is 1.3000 and you think that there will be a price hike in the EUR/USD than that level after an hour.

Next, you will see the platform for trading and will check that the payout by broker is 79%% on a one-hour option contract with a target strike of 1.3000.

After a long assumption, you will finalize to buy a “call” (or “up”) option and risk a $100.00 premium.

You can say it's like to go for a long period of EUR / USD on the forex market.

As the above calculations show that the risk taken by you is limited to the premium paid on the option.

You can't lose more than your part. In contrast to the Forex Trading, where your losses can grow, the trade is against you (therefore it is important to use the stop), the risk of binary options trading is absolutely limited.

Payouts in Binary Options

Now we have seen a simple binary trade mechanics, we think you will learn its high time to learn how payouts are calculated for you.

Maximum often, the payout will be set by the size of your capital at per trade risk you taken, whether the trade is closed, trade your options, and your broker type commission rate

According to above example, you bet $ 100 that EUR / USD will close more than 1.3000 after an hour after offering 79% payment rate with your broker. Let's see that your analysis was on the occasion and your trade is facing the money (ITM). You will then pay $ 179.

$100 (your initial investment) + $79 (79% of your initial capital) = $179

You must know that there is no size to calculate the payments - all formulas. There are many other factors that affect them. These factors are discussed under:

Factors in Payout Calculations

Each broker has its own payout rate. For starters, Forex Ninja’s intel shows that most brokers offer somewhere between 70% and 75% for the most basic option plays while there are those who offer as low as 65%.

Payout rate is generally different for every broker. According to Forex Ninja’s intel some brokers give between 70% and 75% for the most basic options while some offers 65% low payout rate.

The Percentage payout is determine by various factors

The asset that is traded and expiring tenure are big parts to the equation.

Usually, the volatility of a market is less and tenure for expiration is longer which results the lower percentage payout.

The payout rate has also another major factor which is the commission of a broker; meanwhile the services from the broker are given to you and traders to enhance the market ideas for its compensation.

The commission rate does not depends upon the brokers, but the brokers out there (and more coming along), the rates should become increasingly competitive over time due to a large number of binary options.

When a Binary Options Trade is Closed

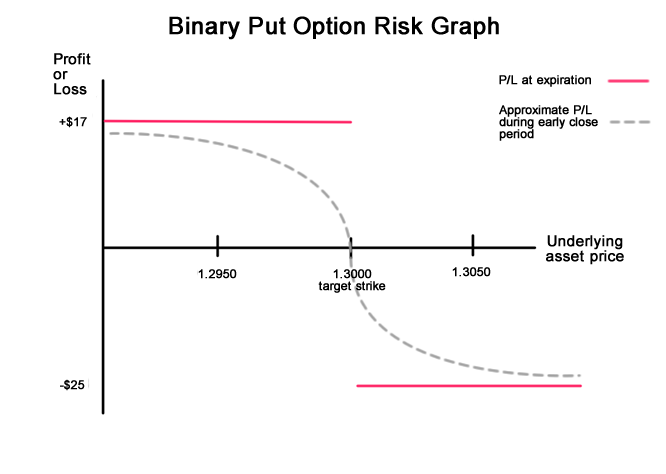

As we discussed earlier, the binary options are trading instruments which show the pay or loss in the contract expiration but some brokers are also there that allows you to close the trade of binary options before expiration.

Normally, it depends on the type of option, and only available within a particular time period (e.g., available 5 minutes after an option trade opens, up until 5 minutes before an option expiration).

The feature of his flexible time period has a trade-off and broker allows early trade closure will have lower payout rates.

The value of the option tends to move along with the value of the underlying asset, when trading with a binary options provider that allows early closure of an options trade,

For instance, with a “put” (or “down”) option play, the value of the option contract increases as the market moves below the target (strike) price.

This indicates that, the option may have greater closing value than paid risk premium (but never greater than the agreed maximum payout) depending upon how far it has moved past the strike.

Contrary to this, if the underlying market undergoes an increase, out of money, the value of the option contract decreases, and the option buyer will be refunded much less than the premium paid if he closes soon.

Of course, the broker commission is included in the payment of the option trade when the skin is closed in both cases.

So before you decide to jump to the top in trading binary options, make sure you do your research and find out what your broker's payment rates and terms are!

3 Types of Binary Options

The types of binary options traded is the is the main factor for payouts

The previously given example of the options trade is a simplest form and type of an up/down option.

The prediction making if the currency pair would be higher or lower the strike price before its tenure comes to expiration gives a lowest return

This averages between 70%-90% depending on your broker.

However, the options comprise of more complicated forms like the “touch and range” binary options, which have higher payouts since winning such trades tends to be harder.

We can conclude that, brokers usually offer payouts around 200%-400% and a few can even go as high as 750%!

Up/Down Options

An Up/Down option can have different alternative names like High/Low, Above/Below, and Over/Under. It is the simplest and most common type of binary option.

A “call” option is simply purchased by the traders if they believe that the closing price will be high than strike price after the expiration of the contract, or buy a “put” option if they think that market will close below the strike price at expiration.

As the trade example of EUR/USD given earlier, indicates the functionality of un Up/Down option.

The simplicity of this option is why Up/Down options usually have the lowest payouts.

As mentioned earlier that Up/Down options expire within an hour or a day, but some brokers are offering options that expire in minutes. Even, some even expire in seconds!

And finally your account can perform best or even can cause a lot of loss. So ensure the careful and proper management of your risk.

Touch Options

The One-Touch option only requires to TOUCH the strike price at east once during the time period of option contract which it becomes profitable and it does not need the lower or higher market rate when it comes to an expiration.

On the other side, the NO Touch trades need that market price DOES NOT TOUCH the strike price during the tenure of the contract for a trader to make profits.

Touch trades are done in various times of the day and some broker offers this opportunity during weekends and weekends touch trades usually provide higher payouts (around 250%-400% of your risk premium) than a simple Up/Down option trade.

For example, let’s suppose that EUR/USD closed at 1.3100 on Friday.

At the weekend you will be offered a call option by your broker where you will profit if EUR/USD touches 1.3450 at least once next week and a put option where you will profit if the pair touches 1.2750 at least once in the same period.

You make decision to take the call option. You find that during the option period EUR/USD had reached a high of 1.3600 before it closed at 1.3050.

When market touches the call option’s strike price (1.3450) within the option period, you may won the trade even if it didn’t close above the level.

On the other hand, those who took a No-Touch option on the same price would have lost their trades since the pair DID touch the strike price.

Touch trades normally performs better when volatility is high while no-touch trades are ideal for pairs that have a tendency to consolidate.

You can also trade with Double Touch/Double No-Touch options!

They are just like Touch/No-Touch options, only with two strike prices. The asset’s price has to touch (or not touch) two different levels for a trader to win the trade.

Range Options

Trading Range/Boundary/Tunnel options is same as playing the Super Mario underwater level where Mario cannot touch both the top and the bottom of the screen.

For In Range trades, the market price must be within a predetermined range and should not touch the two strike prices within the option period in order for your trade to be in-the-money.

Out of Range options are offered by some brokers who allow traders to gain profit in the case when price is broken out of already set range within the option period.

For instance the current trade of EUR/USD is at 1.3300 and the ECB decision will be made within few minutes.

Your broker is offering a range option between 1.3280 and 1.3320 that expires in one hour. You think that the ECB’s decision is a non-event so you bought an “in-range” option.

If you are provided with range option between 1.3280 and 1.3320 by your broker which expires within one hour then you realize that the decision of ECB is non event so bought an “in range” option.

If the price doesn’t reach 1.3280 or 1.3320 within the option period, then you would have won your trade.

It must be good news for you because range options usually have the highest payouts with a few brokers offering between 200%-750%!

Range options are best used when volatility is low, although some brokers offer the option to take a risk on the idea that price WILL break out of the predetermined range.

Alternatively, a few brokers also offer options on predetermined ranges that are far from the current market price.

Market Analysis For Binary Options

It is to recall you that we introduced you with three types of Market Analysis in the beginning. These three market analysis are:

- Fundamental Analysis

- Technical Analysis

- Sentiment Analysis

Here we are introducing these again because they can also be use in binary options trading.

Fundamental Analysis

Trading the News

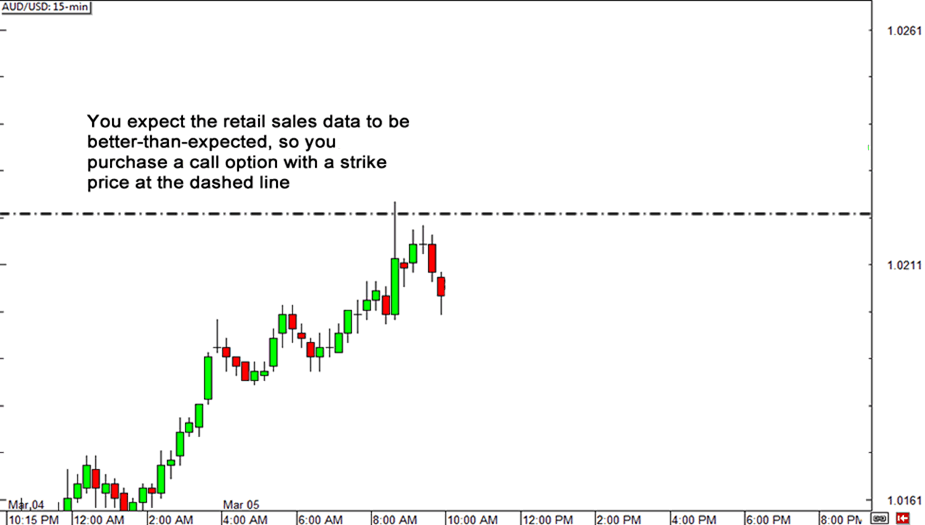

Fundamental analysis provides a way to adopt a trade-the-news strategy.

If you understood the previous lessons on this strategy, then you will realize that this is best applied to those events that usually cause a ton of volatility. Increased volatility leads to faster movements that can cause prices to rise or fall.

This can be effective particularly when you trade simple Up/Down options in binary options.

Finally, you need to understand that how price will react to better/worse than expected data and how strong the reaction may be. You must be confirmed about the price can reach the strike price of option that you purchased.

For example, you decide to trade the Australian retail sales report. Let’s say you have a bullish favor on the results.

The better than expected result will come to the new highs. So you should wait to buy a “call” option on AUD/USD.

Now suppose that, as you expected, we get better results than expected. Fortunately, AUD / USD also increased, rising above the strike price.

Of course, there are a few factors to keep in mind when running the news.

The first is the possibility of volatility. When running a news report and buying a binary option, you should be confident enough that the event will cause enough fluctuations so that the price can touch the strike price and stay above / below this level.

If you try to trade a report that causes a wave very rare, you are throwing money down the drain.

Second, you need to factor in the time fraction of binary options.

Remember, for easy up / down options, the price must be above or below the strike price on the expiration date.

You can also consider going with One Touch Options as the price only has to be touched and does not have to be closed at any particular level, when trading binary options and implementing a news trading strategy.

If you expect the price to move with strong momentum away from its previous range, you can also go with the Out of Range options.

There is no need to set the direction within this option, just decide whether or not the market will move big time in one direction or another.

Technical Analysis

Do you like to use indicators like Bollinger bands, and Stochastic?

Don’t get confused or afraid to include these indicators on your trading charts while you go to trade binary options.

Remember, these indicators will guide you where the next price action can go.

All types of trading market are using these indicators and not only spot currencies.

Remember, you must have good knowledge about the functionality before adding it into your analysis.

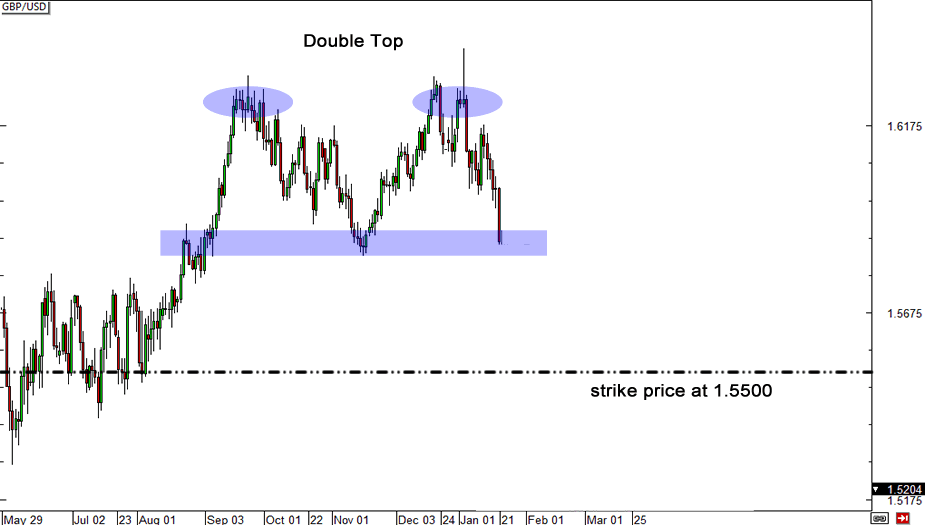

Studying technical levels and inflection points may also prove helpful when you trade binary options.

For better binary option trading knowledge about technical levels and inflection points may also assist you.

Now see this example on GBP/USD.

Price has just broken down from a double top.

With this behavioral pattern, price normally goes to trade lower at a distance equivalent to the height of the double top.

One way you could play this is by taking a One-Touch trade.

The strike price lies between 1.5450-1.5550 offered by broker which is within the height of the double top, buying a “put” option might be a setup worth considering.

Sentiment Analysis

The function of measuring the market’s ongoing “feeling” with regard to broad risk flows is known as sentiment analysis.

Are traders confident in buying risky assets or will they reduce risk by buying safe haven assets or going in cash? This type of analysis will be especially useful when trying to advance trends.

Will EUR / USD break to new highs? Or do you think the trend is over and not fast enough? You can use sentiment analysis to know the feeling of the market.

If it seems that risk appetite is still at a high with no potential changes to the market themes anytime soon, then the chances are we could see the trend continue.

When it is shown that risk appetite is continuously at the highs without any potential change to the market trends anytime, then we can get chances of the trend to continue.

If it is confirmed to you that the risk on environment will be favored by market sentiment, you should purchase a “call” option on a risk currency or asset (e.g., Australian or New Zealand Dollar, Equities, Commodities, etc.)

On the other side, if you find the ongoing reversal in sentiment and know depending upon how overdone the move is then you can try to purchase put” option on those same risk currencies or assets.

Combination

Meanwhile, sentiment analysis may let you know whether the market is in a risk-on or risk-off mood.

Just like in spot forex trading, it is not necessary what kind of analysis you choose because they are not mutually exclusive.

Actually, you can make a combination of all kinds of analysis to build the basis of any trade you take.

The fundamentals can help you figure out which direction you want to go, while technical analysis will help determine your chances of reaching the market, breaking down, and finding support / resistance at a specific price.

Meanwhile, emotional analysis can tell you if the market is risky or off-risky.

Finally, you can learn from all your mistakes and gain experience. As time passes, this process will help you to make your analysis in a better way and you will be able to form better trading practices.

Are Binary Options Regulated?

The regulators are being attracted towards the binary options trading from very recent and it is a new player in the ground of trading. Now many brokers from both new and old industry are offering binary options trading

There aren’t many regulators waiting for binary options trading at the moment. Unlike spot forex trading, which is overseen by the CFTC, NFA, or other foreign regulatory agencies.

No doubt, the new regulations are being set for new way of trading and binary options are getting popular.

Cyprus Securities and Exchange Commission (CySEC) was the first regulatory body to consider binary options trading as a financial instrument back in May 2012.

In the United States, Bank de Binary, one of the leading binary options brokers, took the initiative to seek regulation from the CFTC for its operations. Other binary options brokers are expected to follow suit.

Around the world, other regulatory agencies are also starting to keep a close eye on binary options trading. The Japanese Financial Services Authority is making its own regulations for Japan, the world's largest market for product.

The Maltese Financial Services Authority (MFSA) is preparing to take charge of regulating binary options brokers in the country in Malta.

Accordingly, brokers will go through the application process and go through a rigorous process to secure their working licenses.

Potential application requirements include that binary options brokers are licensed under Investment Services Category 3 and will require a minimum investment of € 730,000.

If you are planning to open a binary options account, make sure you do so with a regulated broker.

Regulated brokers are generally set to high operating standards, and if you have problems (e.g., commercial execution, fundraising, etc.), you have to work with the broker to help resolve those issues. There is more power.

Although unregulated brokers should not automatically be seen as scammers, trading with them can pose risks, such as the lack of a guarantee that the firm's operating funds will be kept separate from the client's funds.

Also, if you have a problem, there will be no one to hear your case and take action on your behalf.

Binary Options vs Forex

Binary options trading have long been over the counter, only in the last few years it has grown exponentially.

Now, about 90 companies (including those who label their products white) offer some kind of binary options trading service.

Well, it's a growing industry; but why involve yourself?

[bpad unit="inline_sidebar_med_rect"]Why should you learn a whole new type of trading when you’re already learning spot forex? Isn’t it better to something you already know?

There are many advantages and disadvantages to both binary options and spot forex.

[bpad unit="inline_half_page"]We’ll touch upon a few and hopefully, you can determine which trading instrument may be right for your trading style.

Max Risk

One of the best things regarding binary options trading is that the right maximum profit or loss known to you in advance.

The trader controls the risk premium to enter the binary options trade, and this is the only amount that can be completely lost.

Most binary options trading service providers allow you to minimize your losses by "folding" your trade before the expiration date after certain conditions have been met.

Contrary to it, with Spot Forex, even with a set of stop loss orders, you cannot be 100% sure that you will only lose the pre-calculated amount that you risked.

While impossible, there is always the possibility that certain issues may affect your ultimate maximum risk, such as slipping, lack of liquidity to execute a stop order at the desired price, and the broker's trading platform goes down, etc.

Trade Management Flexibility and Maximizing Reward

In addition to high / low options, many binary options plays are only available at certain times of the day or week, and brokers set the strike price mostly.

[bpad unit = "inline"] Even if you have an idea of how the market can behave within a certain time frame, you may not have the best option to run your idea.

With Spot Forex, you are able to place limit orders or execute market orders for any price at any time during open market hours.

In the case of an exit from an open trade, some binary options brokers allow you to close an option trade early, but usually after the opening of an option trade and before it closes. after the.

And as mentioned earlier, the value returned to the trader depends on whether there is money in the market or outside and obviously, a piece goes to the broker.

In Spot Forex, you can close your trade at any time (except on weekends with most brokers). Even if it's a second in the trade, you can go out and sell profits or reduce losses.

Finally, if you think there is going to be a long trend and you want to maximize your profits by stopping it for as long as possible, you can do so by using the scaling in and trailing stop techniques in the spot market. Are

With binary options, the expiration date and profit margin limit you. As soon as you close or run out of options, you are out of business.

Depending on your risk and risk management preferences, either trading instrument can be good or bad depending on how much time you want to spend in front of your trading platform, how active you want to be, or your What the market is expected to do.

Transaction Costs

There are no additional transaction costs other than what is normally factored into the final payout In binary options trading.

In spot forex, the transaction cost comes in the form of a spread, a commission, or both. We’ve already discussed this in a previous chapter, but feel free to revisit the lesson and read up on it again.

Trade Choices

While currency pairs are the most common assets you can trade, with some binary options brokers, you may also have the opportunity to trade your ideas on a limited number of individual stocks, stock indices, and even commodities.

Another best thing about binary options trading is that you are not limited to currency pairs as with most retail forex brokers.

While currency pairs are the most common assets you can trade, with some binary options brokers, you have the opportunity to trade your ideas on a limited number of individual stocks, stock indexes, and even commodities.

Volatility Risk

Surprising volatility in Binary options trading is usually not a problem. Whatever you trade can eliminate the volatility caused by certain events.

[bpad unit="inline"]Provided that your view turns out to be correct, you don’t need to worry about the market’s knee-jerk reactions.

The max risk is still set, but so is the max reward.

In spot forex, however, sharp swings can affect the value of a position greatly and very quickly, which makes the additional task of setting up proper risk management processes very important.

Trader Error

The chances of an error in binary options trading are very less when entering a trade.

The reason behind it is that there are only two actions to take with binary options: open and close.

There is no limit to keep track or close or adjust. In Spot Forex, a careless trader may forget to place an exit and / or adjustment order, which could potentially cause more damage than intended.

Binary Options Banned

The aggressive marketing of binary options for novice traders by (mainly) unlicensed brokers in the mid-2010s led to an increase in scams where traders traded with a large number of these brokers and could not withdraw money, in many countries and regions banned binary options such as EU, UK, and Australia.

A

Abandoned Baby | Account Statement Report | Account Value | Accumulation Area | Accumulative Swing Index ASI | Address | ADDY | ADP National Employment Report | Advance Or Decline Index | Afghanistan Afghanis | Agency Model | Aggressor | Alan Bollard | Alan Greenspan | Albania Leke | Algerian Algeria Dinars | Alligator | Altcoin | Analysts | Andrews Pitchfork | Angela Merkel | Angola Kwanza | Anti Money Laundering AML | ANZ Commodity Price Index | Application Programming Interface API | Appreciation | Arbitrage | Argentina Pesos | Armenian Drams | Aroon Oscillator | Aroon Up And Down | Aruban Guilder | Ascending Channel | Ascending Trend Line | Ascending Triangle | ASIC Mining | Asset | Asset Purchase Programme APP | Asset Purchases | Asymmetric Encryption | Asymmetric Slippage

B

Bag | Bag Holder | Bahmas Dollars | Bahrain Dinars | Bail In | Bail Out | Balance Of Trade | Baltic Dry Index | Bangladesh Taka | Bank Levy | Bank Of Canada BOC | Bank Of England BOE | Bank Of International Settlement BIS | Bank Of Japan BoJ | Bank Run | Bank Run | Banking Institutions | Bar Chart | Barbados Dollars | Base Currency | Base Rate | Basing | Basing Point | Bear | Bear Flag | Bear Market | Bear Trap | Bearish | Binary Options | Bitcoin Cash | Bitcoin Maximalist | Bitcoin Or BTC | Block | Block Explorer | Block Header | Block Height | Block Reward | Blockchain | Blue Chip | Bolivia Bolivianos | Bollinger Bands | Bond | Bond Auction | Bond Yeild | Book | Boris Schlossberg | Botswana Pulas | Brazilian Brazil Real | Breakdown | Breakeven | Breakout | Brent Crude | Bretton Woods Agreement Of 1944 | BRIC | Broadening Formation | Broker | BTD | BTFD | Bucket Shop | Bulgarian Leva | Bull | Bull Flag | Bull Market | Bull Trap | Bullish | Bullish Engulfing Pattern | Bundesbank | Burundi Francs | Business Inventories | Buy Side | Buying Pressure

C

Cable | Camarilla Pivot Points | Cambist | Cambodian Riels | Canadian Dollar | Cape Verde Escudos | Carbon Credits | Cardano ADA | Carry Trade | Cash Market | Catalyst | Cayman Islands Dollars | Cboe Eurocurrency Volatility Index | Central Bank | Central Bank Digital Currency | Central Bank Intervention | Central Counterparty Clearing Houses CCPs | Central Limit Order Book Or CLOB | Chaikin Oscillator | Chart Pattern | Chartist | Chicago PMI | Chilean Peso | Chinese Renminbi | Chinese Yuan | Christine Lagarde | Circulating Supply | Cleared Funds | Clearing | Clearing Price | Client | Closed Position | Cloud Mining | Coin Age | Cold Storage | Collateral | Colombian Pesos | Comdoll | Commercial Corporations | Commission | Commitments Of Traders Report Or COT | Commodity | Commodity Channel Index Or CCI | Commodity Futures Trading Commission CFTC | Commodity Research Bureau Index | Commodity Trading Advisor CTA | Communaute Financiere Africaine Francs | Comoros Francs | Completeness | Compound COPM | Comptoirs Francais Du Pacifique Francs | Conference Board Consumer Confidence Index CCI | Confirmation | Confluence | Congo Congolese Francs | Consensus Algorithm | Consolidation | Consumer Price Index CPI

ForexTrading.pk